- Green Queen Future Food Weekly

- Posts

- $55M For Precision Fermented Egg Proteins - Future Food Weekly

$55M For Precision Fermented Egg Proteins - Future Food Weekly

Plus: 2 exclusives for cultivated meat and major chocolate news. This and more in Green Queen Media's global roundup on future food news.

Morning Folks,

Today’s note is a mish-mash of events and conversations I’ve been having and hearing at various events, on top of all the reporting in this newsletter, which includes multiple exclusives from our reporting team.

Longevity is the new black: In the last 24 hours, I’ve met with an organizer of a major longevity summit in Europe, been invited to a longevity summit in Hong Kong, attended a longevity-themed breakfast and had an investor tell me they were broadening their fund scope to include longevity startups. While Bryan Johnson and his ‘Don’t Die’ platform have certainly helped mainstream longevity, the more pressing factor is the proliferation of rapidly ageing societies across the globe, which is creating headwinds for a space that has been hitherto populated by nerdy biohackers and wellness retreat addicts. It’s a fascinating sector, and unsurprisingly, I am most curious about what eating for longevity looks like. So far, what I’ve learnt is it’s a mostly plant-based affair, ideally there’s minimal cow dairy, fasting is key and bitters are very important.

Not All-In on alt proteins: South African ag tech entrepreneur and VC David Friedberg is not optimistic about alternative proteins despite being bullish on ag and farm tech (he is long on robotics). The popular podcaster (he co-hosts the All-In show) spoke at a fireside chat with Temasek’s Anuj Maheshwari at Singapore Agri-Food Weekd, during which he talked about the sector’s major headwinds: 1) US Republican backlash against cultivated meat (he said a total of 18 states may ban the tech—currently 8 have), 2) the MAHA movement’s fight on ultra-processed foods affecting plant-based alternatives, and 3) the FDA’s plan to eliminate ‘Self-Affirmed’ GRAS, which will slow down fermentation ingredient companies.

Does GLP-1 kill consumption? This nugget came out of a fascinating off-the-record chat I had with a CPG analyst who told me she is observing a major shift in folks on these appetite-suppressing drugs that goes way beyond food. We’ve already seen data showing that folks gamble less, do fewer illicit drugs and generally engage in far less risky behavior, but her research shows that people taking Ozempic, Mounjari et al are shopping less. They want less, they crave less, they need less…they buy less. Of everything. If this is true, then as more and more people start taking these drugs, the effect on the global economy could be profound. On the plus side, it could be a boon for the climate crisis and emissions. So much to unpack here. If anyone has any data/research to share on the topic, please send.

-Sonalie

💡 Only On Green Queen

🤝🏼 Exclusive: Fork & Good Acquires Orbillion to Take Cultivated Red Meat Platform Global

US startup Fork & Good has acquired fellow cultivated meat producer Orbillion Bio to combine their global operations and fast-track the launch of their proteins. Here’s what that will look like.

🇸🇬 Exclusive: Hoxton Farms Files for Singapore Approval of Cultivated Pork Fat

British cultivated meat startup Hoxton Farms has submitted a regulatory dossier to the Singapore Food Agency, with filings in the UK, North America and other Asian countries to follow soon.

❓Opinion: The UK’s Precision Fermentation Pilot is Proof That Regulation is A Startup Ally

Regulatory expert Stephen O’Rourke suggests that for food tech founders, the real advantage isn’t speed – it’s knowing what regulators expect before you apply.

💥 Fermentation Frenzy

🍳 California-based The Every Company raised $55 million Series D funding to expand production of its precision-fermented egg proteins, following a nationwide rollout at Walmart.

💡The round marks the third-largest sum raised by an alternative protein firm in 2025, and takes the startup’s total raised to $288 million.

🇨🇳 China’s Angel Yeast has begun operating an 11,000-tonne production line for its yeast protein, with built-in expansion capacity to meet future market growth.

💡The demand for yeast protein is expanding rapidl; the market is already worth $1.5 billion today, and is set to grow by 8.5% annually to reach $2.3 billion in 2030.

🍫 The world’s largest chocolate supplier, Barry Callebaut, has teamed up with Germany’s Planet A Foods to produce alternatives with its cocoa-free chocolate, ChoViva, made via a proprietary fermentation process.

✅ Must-Read Headlines

🇺🇸 A new federal bill calls on the US government to create a $10 million pilot grant programme to expand voluntary access to plant-based meals in schools.

💡Importantly, the programme is entirely voluntary and does not restrict or eliminate animal proteins – instead, it seeks to expand choice and help schools overcome barriers like limited funding, training, and technical support.

📈 Swedish oat milk pioneer Oatly delivered profitable growth in Q3 2025, marking the first time it has done so since its IPO four years ago, thanks to its “Gen Z-driven flavour bonanza” strategy.

💡This success came largely on the back of consistent performance in Europe and a strong quarter in the Greater China segment, though was partially offset by weakening sales in the US.

🧫 More Cultivated News

🐟 US startup Atlantic Fish Co netted $1.2 million in new funding, which it will use to optimise its cultivated seafood fillets, scope out partnerships, and prepare regulatory filings.

💡Atlantic Fish Co’s cell culture platform works across any species, but its initial focus is on high-value whitefish.

✅ Israel’s Believer Meats received official clearance from the USDA to produce and sell its cultivated chicken in the country, becoming the first non-US startup to reach the milestone.

💡The cultivated meat industry may have struggled to attract investors lately and had to contend with bans in seven US states, but on a regulatory front, it has been a watershed year.

🧫 Australia’s Vow launched its cultivated meat products for at-home use, including foie gras, a smoked spread, and croquettes.

💡The Japanese cultured quail offerings are being rolled out in fashion-industry-style ‘drops’, starting with the firm’s hometown of Sydney - could this create the positive buzz the industry needs?

💰 Key Research & Consumer Insights

📉 A University of Oxford study suggests that plant-rich diets could lower agricultural labour costs by nearly $1 trillion annually, calling on governments to support livestock farmers with the transition.

🥓 Cutting back on bacon and burgers could release the disease burden in rich countries and save their ailing healthcare systems, according to a new analysis from Zero Carbon Analytics.

🇸🇬 Over nine in 10 Singaporeans say they’d replace a portion of their meat with blended proteins, according to a blind taste test conducted by the A*STAR Singapore Institute of Food and Biotechnology Innovation, with this one product outperforming 100% chicken mince on taste.

🇺🇸 A new study by the World Resources Institute reveals that losing track of food and being too busy are among the key drivers of household food waste in the US.

🇩🇪 In Germany, a vegan shopping basket is now 5% more affordable than one with meat, dairy and seafood, according to data from ProVeg International, reversing a trend that has long plagued the adoption of plant-based alternatives.

🌱 According to a poll by Morning Consult and the Physicians Committee for Responsible Medicine, a majority of Americans agree that students should have access to plant-based meals and non-dairy milk in school lunches, aligning with a bipartisan bill in the Senate.

🚀 Everything Else In Future Food

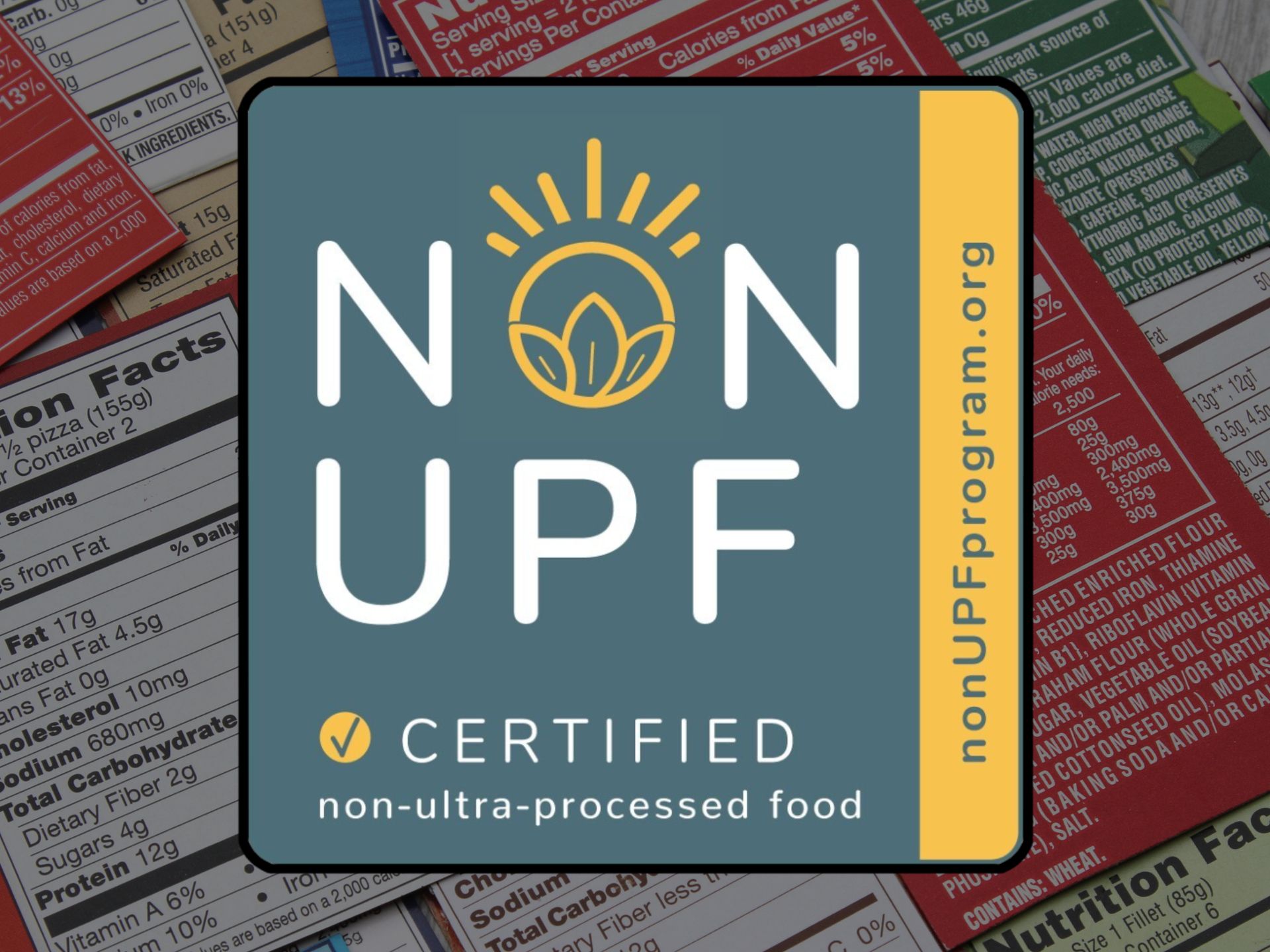

📜 Food companies can now label their products as free from ultra-processed ingredients, thanks to a new certification from the Non-UPF Program in the US, keying into a central focus of health discourse in the country.

👎🏼 Fast-food chain Burger King has walked back on its pledge to swap dairy for Oatly’s barista milk in hot drinks in Austria, announcing that cow’s milk will remain on the menu. Here’s what happened.

🌱🍔 Future Food Quick Bites

In our weekly column, Future Food Quick Bites, we round up the latest news and developments in the alternative protein and sustainable food industry. This week, Future Food Quick Bites covers Oatly’s switch to British oats, Eat Just’s pancake mixes, and NotCo’s Stranger Things collab.

📆 Scene & Heard

🚀 Secure Your Spot At The Food Protein Summit 2026

🇺🇸 The Food Protein Summit 2026, happening 15th-16th April 2026, is where experts in nutrition, science, and technology come together to advance food protein production and support a more accessible, sustainable food system. Learn more here.

🇫🇷 Fi Europe, taking place in Paris from 2nd to 4th December, unites the world's leading food & beverage suppliers, buyers, R&D experts and production specialists all under one roof. Learn more here.

🌱Step into the place where the natural and organic movement was born and where its future continues to unfold at Natural Products Expo West on 4th-6th March. For 45 years, Expo West has been the heartbeat of an industry built on innovation, purpose, and connection; find out more here.

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

The world’s leading global food system founders, investors, policymakers and corporate execs read Future Food Weekly → subscribe now.